Budgeting and sticking to a monthly budget are critical for financial success. When just beginning the process, knowing exactly how much money goes in and out of your home regularly is one habit that you should build.

As with developing any habit, having the right support can be beneficial. The right budget tool for you is a working one: whether it’s a fully loaded app, an advanced spreadsheet, or pen and paper. To aid your search for the appropriate budgeting app, there is a list of 5 best budgeting apps.

Best Free Budgeting Apps

- YNAB (You Need A Budget)

- Goodbudget

- PocketGuard

- Honeydue

- Empower Personal Dashboard

By comparing the fifteen best budgeting apps, we identified some of the best mobile applications to manage your finances at an affordable cost with ease. In this list, we highlighted apps that were available to U.S consumers The 5 applications shown here feature a range of helpful functionalities and tools that can address different financial management requirements. App details are current as of January 2024.

1. YNAB

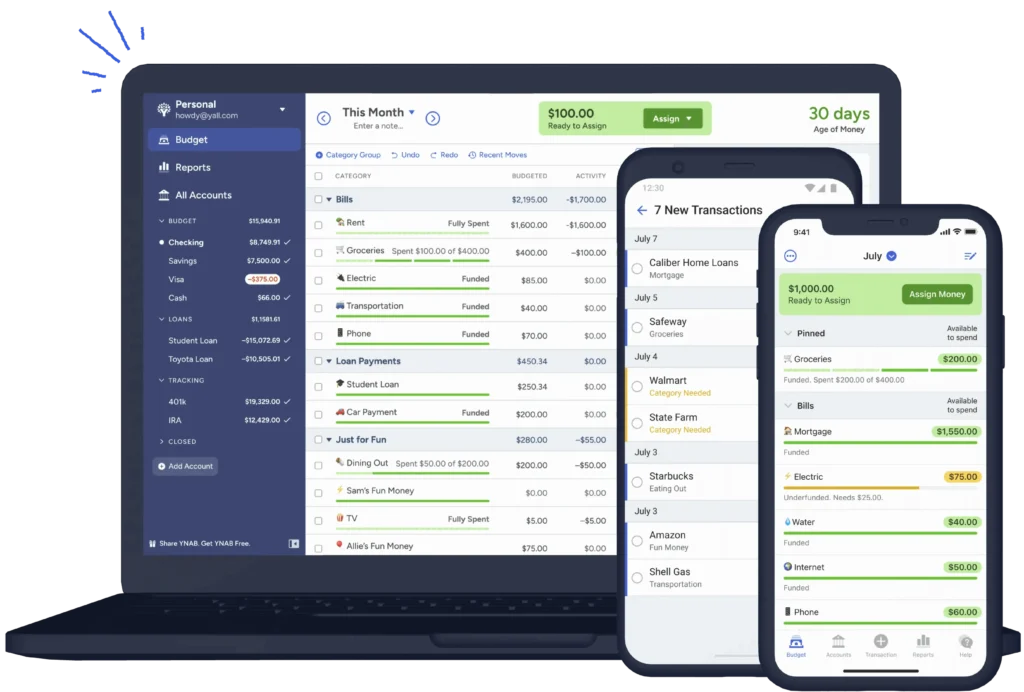

YNAB is an acronym for You Need A Budget, an award-winning budgeting program that focuses on helping consumers save money and get rid of debt.

YNAB is not proud about going back in history to find out financial insights but rather concentrates its efforts on where you are presently and what your future looks like. This app helps users with determining what their financial priorities and goals are, as well as giving each dollar a purpose. These priorities have led to the positive attitude of the majority of customers.

In the app itself, there are several functions designed to put customers on track for proper budgeting. Financial goal tracking, reporting financial habits, and the support of YNAB staff with resources such as dozens of free online workshops make budgeting a painless process.

YNAB is available on desktops and mobile devices as well as voice-activated devices. YNAB does not require an upfront commitment. You can try it for 34 days without risk. Both iOS and Android versions of the YNAB app are available.

2. Goodbudget

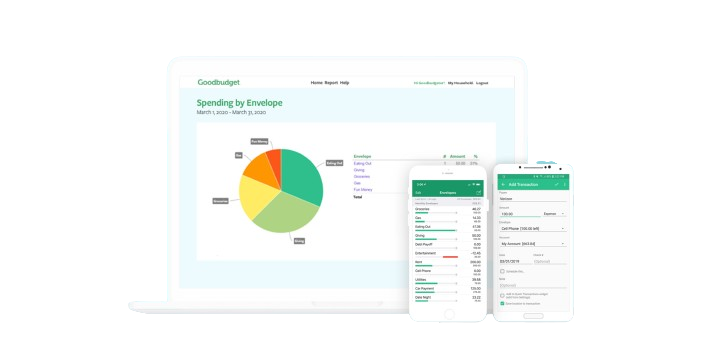

One of the old methods with which to handle money is the envelope system. It included separating your money into separate envelopes with labels prepared, like a rent envelope, grocery envelope, bill envelope, and a fun-based one. Using this budgeting technique, you can also do it using the Goodbudget application digitally.

It is based on the Kakeibo principle, a Japanese term that translates to “household account book”. This approach is ideal for setting aside money towards a big purchase, whether it’s the down payment on a house or just paying off debt in general.

The same goes for the Goodbudget app is also great for shared household budget which syncs with more than one person. Furthermore, Goodbudget offers an educational platform that features budget bootcamp webinars podcasts, and informative blog posts for further financial knowledge.

The free version is close to the paid one. The Plus version has the same features but with additional functionalities. For instance, the free version provides 20 envelopes per account to organize your money while the paid one gives you an unlimited number of them.

The device can be a mobile phone, tablet, or desktop. The Goodbudget app is available for iOS and Android.

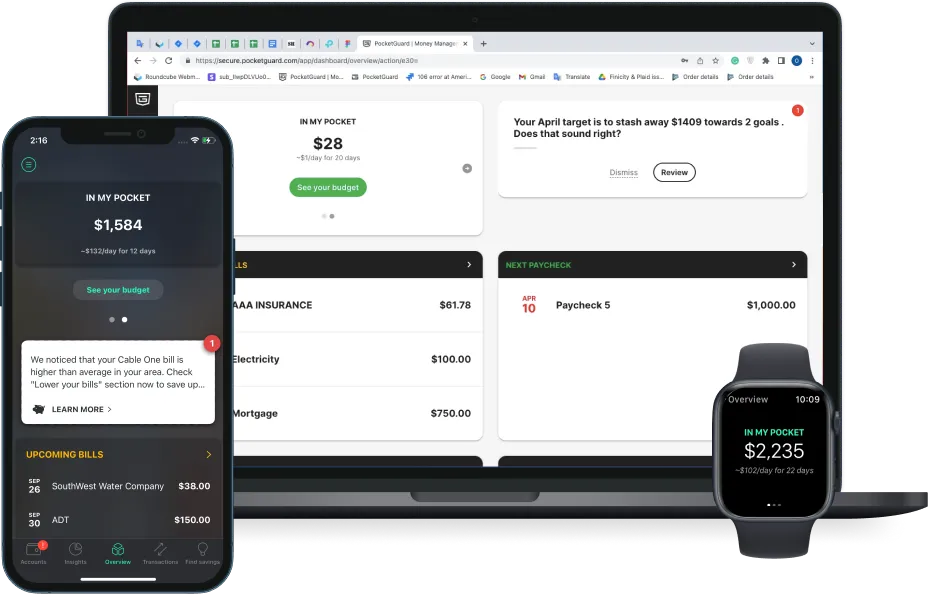

3. PocketGuard

PocketGuard is an effective the best budgeting app for its ability to show the simple numbers: the amount of money that you have, your bills, and whatever is left over. The application also indicates to you where most of the cash is going and does so in a customizable pie chart. You can set spending caps in the app itself to help remind yourself of possible overspending.

One outstanding feature of the app is that you can link your repeated expenses, which can help to negotiate better rates on some bills like cable bills or cell phones. The program does this by providing personalized offers to its clients after they fill in the information in their profile portion.

In My Pocket is a feature that allows you to have better control over cash flow since the software has information on your bills, budgets, and anything else related. You have to connect your bank accounts and credit accounts, in case of the In My Pocket application. As soon as you have determined your recurring income, expenses, and the amount that should go to savings goals every month or year – PocketGuard will work out what would be Spend/Save.

Note that the app restricts some functions in this version for free, such as monitoring cash flow and creating your spending categories.

4. Honeydue

Many couples disagree on household finances. The goal of Honeydue is to improve communication and provide better transparency regarding expenses, budgets, and finances.

In the app, they can chat about spending without resorting to texting or calling their partner. By adding automated bill reminders to that, you and your partner can communicate better about the bills. Alternatively, you can specify from within the app that a single person will take responsibility for an expense or they all will share it equally.

To begin using the app, connect your bank accounts to it. The app serves more than 20,000 financial bodies. You can also set up a joint Honeydue bank account if you and your partner decide, which is insured by the Federal Deposit Insurance Corporation via Sutton Bank. The account has no fees or minimums, a free debit card that includes access to more than 55,000 surcharge-free ATMs as well as Apple Pay and Google Pay. It can also be used to send immediate notifications to your partner. Honeydue app is both iOS and Android compatible.

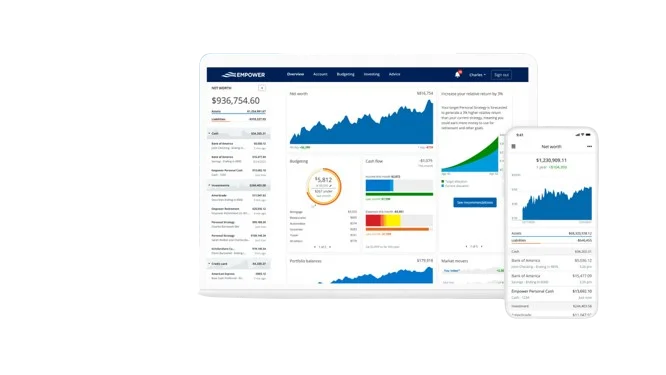

5. Empower Personal Dashboard

The outstanding reporting, desktop, investment management platform, and spending tracking make Empower Personal Dashboard (formerly available as Personal Capital) the best budgeting app for investors. Empower provides a comprehensive picture of customers’ entire financial lives, ranging from short-term spending dynamics to tracking portfolio performance.

The app features different savings tools that are tailored to help in accumulating retirement funds and a rainy day account as well as for repaying loans. It also offers great helping services which include an investment checkup, investment fee analyzer financial planning cash flow tracking, and at the same time one can easily reproduce their net worth in real-time. All these tools provide close insights into your current financial status alongside assisting you in planning for the future.

The list of functions may seem impressive but the ease with which one can use this application is just remarkable. Empower offers a desktop version that provides users with an alternative multiplatform tool for managing their financial affairs.

Linking bank accounts, credit cards, student loans, mortgages and other debts that appear on the budget is also simple. From that point on, the app will obtain data to generate a comprehensive financial portrait. The Empower app can be used on iOS and Android platforms.

A best budgeting app selection guide

However, when making the best budgeting app choice you should consider features that matter to most and will be beneficial in the long run. The ideal best budgeting app and approach will be the one that you can keep using to remain accountable for your objectives. To help narrow down your options, consider the following:

Budgeting and sticking to a monthly budget are critical for financial success. When just beginning the process, knowing exactly how much money goes in and out of your home regularly is one habit that you should build.

As with developing any habit, having the right support can be beneficial. The right budget tool for you is a working one: whether it’s a fully loaded app, an advanced spreadsheet, or pen and paper. To aid your search for the appropriate budgeting app, there is a list of 5 best budgeting apps.

Best budgeting apps

- YNAB (You Need A Budget)

- Goodbudget

- PocketGuard

- Honeydue

- Empower Personal Dashboard

By comparing the fifteen best budgeting apps, we identified some of the best mobile applications to manage your finances at an affordable cost with ease. In this list, we highlighted apps that were available to U.S consumers The 5 applications shown here feature a range of helpful functionalities and tools that can address different financial management requirements. App details are current as of January 2024.